Warren Buffett credits it as the most powerful factor in his investing successes.

Albert Einstein calls this the 8th wonder of the world. He who understands it, earns it.. he who doesn’t… pays it.

Compound interest!

In this article, we highlight (with relevant examples) the mighty power of compounding.

Case study 1

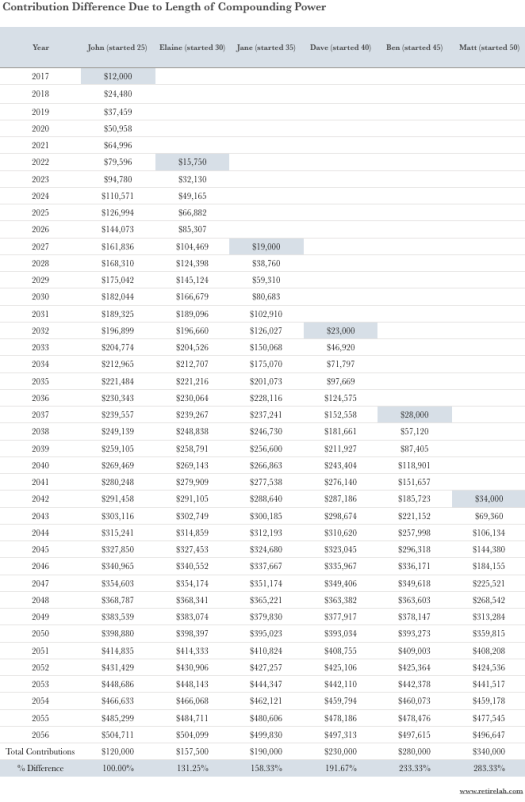

John started saving $12,000 annually ($1,000 per month) from 25 years old to 65 (40 years). Assuming his portfolio generates a 4% return, his $480,000 contribution will be at a handsome $1.14million at the end of 40 years. Have a look at the different amounts by saving $1,000 monthly at different ages.

The differences in interest earned due to compounding power is evident! Here’s another case study to illustrate the power of compounding. Here we look at the difference in monthly contributions because we allow more(less) time for compound interest to work for us!

Due to the length of time to let compounding work its magic, John only contributed $12,000 yearly compared to Matt’s $34,000 (~2.83 times) to achieve similar results. That’s a big big difference!

As the investor John C Boyle puts it, “Time is your friend; impulse your enemy.” Finding a portfolio that generates 4% returns is not going to be risk free, it is important that we do lots of homework and then make our money work for us. If not, it maybe better to consider either putting it in the bank or putting it in CPF?

Compound interest – Make him your friend (today).

Look out for our next contributions as we will be discussing more about these topics!