Another fact that directly impacts our retirement planning will be the rising cost of living. Inflation.

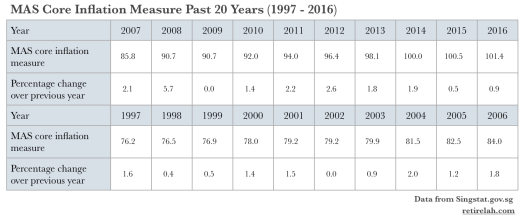

Here we look at the data from singstat.gov.sg

We look at the MAS core inflation measure* which gives important indicator of price developments in Singapore. It is less volatile than the CPI inflation but co-integrated with it.

*Note that the MAS core inflation measure excludes cost of accommodation and private road transport given the high home-ownership rate as well as the long intervals between new car purchase for most owners.

From the table above, we see that inflation in Singapore ranges from 0 – 5.7 percent with 17 out of the 20 years lower than 2.5% and 15 of the 20 years lower than 2%.

We are using 2.5% inflation from this exercise and have created tables to illustrate the difference between taking inflation into consideration and not. The results are significant.

The most recent household expenditure survey (2012/13) by Singstat.gov.sg showed Singapore household spending SGD4,724 monthly.

18 years of net $4724 monthly spending = $1,587,264

18 years of inflation adjusted monthly spending = $2,259,595

That’s a BIG difference of $672,331!

Hence, it is important to note that prices are going to continue going up (especially with all the QE done around the world post 2008 crisis).

Adjusting for inflation is necessary for any retirement planning.

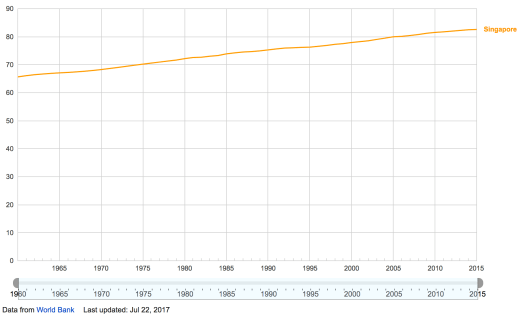

You can read Part 1 of series here; Life Expectancy.

Stay tuned for our next part!